Monetization at Scale and New Initiatives

Skillz Product Management Interview Assignment - What top games teach us, how big the upside is, and exactly how to ship rewarded ads

The Monetization Pod at Skillz is focused on unlocking new revenue streams to enhance player lifetime value while maintaining a fun, fair, and rewarding player experience. Core areas of exploration include rewarded ads, display ads, in-app purchases (IAPs), cosmetic items, battle passes, and subscription models.

Part 1: Market & Competitive Analysis

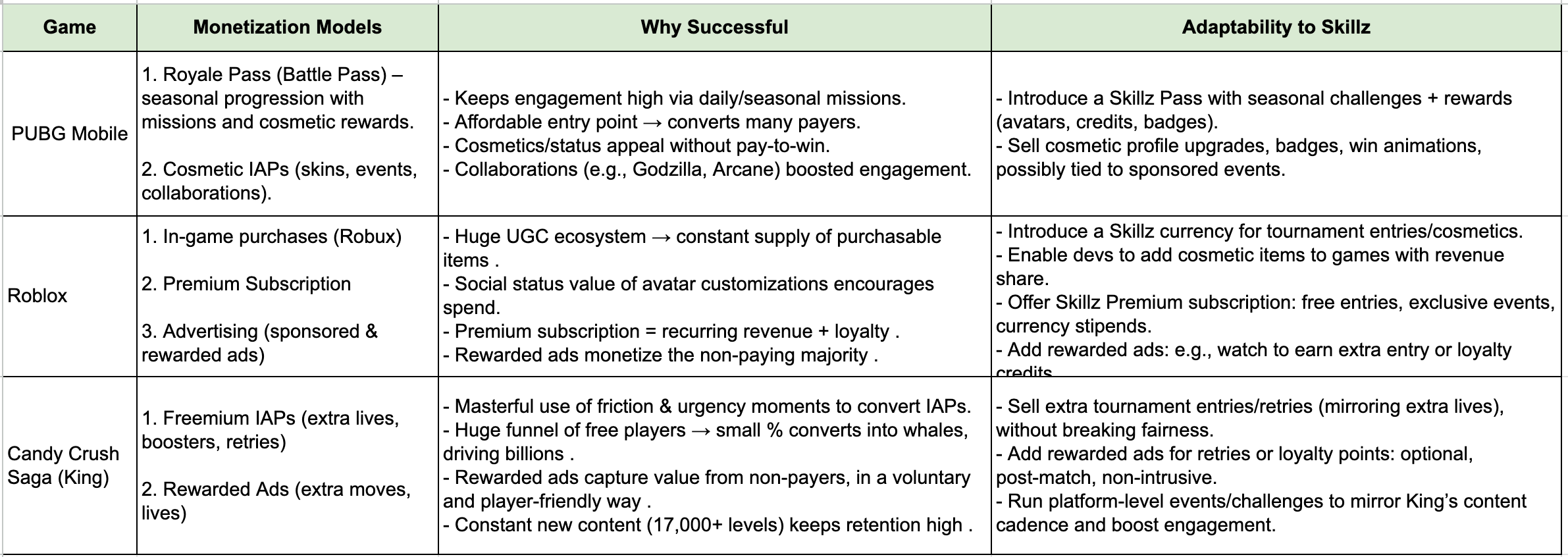

Research 2-3 comparable companies or ecosystems (mobile games, esports, adjacent platforms).

Identify at least two monetization models they’ve used successfully.

Analyze what made those models successful and how/if they could be adapted to Skillz.

PUBG Mobile

PUBG Mobile is a battle royale shooter that has achieved over $10 billion in lifetime revenue, making it one of the highest-grossing mobile games globally. PUBG Mobile’s monetization is exclusively via in-app purchases, avoiding disruptive ads, which helps maintain player retention and enjoyment. Key monetization models include:

Monetization Models:

Seasonal Battle Pass (“Royale Pass”): PUBG Mobile introduced a tiered Battle Pass system in 2018, inspired by Fortnite’s success. Each season, players can purchase the Royale Pass to unlock missions and earn cosmetic rewards (outfits, weapon skins, emotes, etc.) by leveling up the pass. This model drives consistent engagement: players log in daily to complete Royale Pass challenges and progress through tiers. Notably, nearly 50% of top-grossing mobile games use some form of battle pass, underscoring its effectiveness. By offering a stream of rewards at a fixed price, it converts a large base of moderate spenders, rather than relying only on a few big spenders.

It also adds social pressure: PUBG lets paying users form “RP Teams” where a group’s pass progress is combined for extra rewards, motivating friends to buy the pass to not let teammates down. This seasonal pass model has proven so effective that after its introduction, games like Clash of Clans saw a 72% revenue spike in the month after launching a $5 season pass. For PUBG Mobile, the Royale Pass keeps players continually engaged and monetized in cycles, contributing to its 40 million+ MAUs and $600+ million annual revenue in recent years.

Cosmetic In-Game Purchases (Skins & Themed Events): PUBG Mobile monetizes purely through cosmetic items – outfits, weapon skins, parachutes, emotes, etc. – which do not affect gameplay balance. Players acquire cosmetics via direct purchases, crates (loot boxes), or as Royale Pass rewards. These items appeal to players’ desire for personalization and status. Limited-edition skins and crossover events create FOMO (fear of missing out) that spurs spending.

Why These Models Succeeded in PUBG:

Both the Royale Pass and cosmetic sales succeeded because they align monetization with player engagement. The battle pass gives players clear goals and rewards for regular play, effectively increasing retention and lifetime value. Even though the pass is inexpensive (~$10 or less), the massive user base makes up for it, and the pass in turn increases overall IAP spend by boosting activity.

On the other hand, cosmetic IAPs leverage players’ social motivations (status, self-expression) without harming game balance. Exclusive skins (especially time-limited ones) create urgency and community buzz, driving revenue spikes during special events. PUBG’s use of big IP collaborations (like Godzilla, Arcane) attracted both existing fans of those franchises and gave current players novel content, boosting acquisition and monetization simultaneously.

Recommendations for Skillz:

Implement a Seasonal “Skillz Pass” – Skillz can introduce a battle pass style system across its platform. For example, a Skillz Season Challenge Pass could reward players for participating in a series of tournaments. Players who purchase the pass would unlock premium rewards such as bonus Z-coins (virtual currency), exclusive profile badges or avatars, and entry tickets to special tournaments. This would encourage more frequent play and retention, as users strive to complete the pass.

Importantly, rewards should remain cosmetic or access-oriented (non-competitive) to maintain fairness – e.g. unique profile customizations or the ability to enter an invite-only prize event, rather than any in-match advantage. A low-cost seasonal pass (e.g. $5) could significantly broaden Skillz’s payer base by converting casual competitors into paying users, much like PUBG’s Royale Pass drove conversion by offering high perceived value at a modest price. Skillz should also consider adding social features to the pass: for instance, a team-based pass challenge where a group of friends on Skillz collectively earn rewards (mirroring PUBG’s RP Team concept), which can boost referrals and viral engagement on the platform.Cosmetic Monetisation: Introducing customization options for players’ profiles, avatars, or even in-game effects (celebratory animations, custom skins for generic game elements) can open a new revenue stream. For example, players might buy exclusive avatar frames, emotes, or tournament victory animations to show off their Skillz achievements. These cosmetic purchases give players a way to express status (“I won last season’s Skillz Championship”) and personalize their presence on the platform.

Skillz could rotate limited-time cosmetic items (themed around holidays or partner brands) to create urgency and fresh content, just as PUBG does with its seasonal skins. The key is to maximize visibility of cosmetics – e.g. showcase player badges on leaderboards or highlight a winner’s custom avatar in tournament lobbies – so that players derive social prestige from these purchases.

Skillz might explore branded sponsorships for cosmetic content or events, similar to how PUBG Mobile runs branded campaigns without hurting retention. For instance, a sponsorship could fund a free entry tournament with a special cosmetic prize (bearing the sponsor’s theme), yielding value for both the sponsor and the players while adding to Skillz’s income via the sponsorship fee.

Roblox

Roblox is an online platform with millions of user-created games and virtual experiences. It operates on a freemium UGC model – anyone can play for free, and monetization happens through its virtual currency and services.

Monetization Models Used:

In-Game Purchases via Robux: Roblox’s economy runs on Robux, a virtual currency that players purchase with real money. Players spend Robux on a variety of in-game items and upgrades, from avatar cosmetics (clothing, accessories) to game-specific perks or access passes. A portion of every transaction goes to the game’s developer and to Roblox itself. This has been hugely successful – the platform essentially takes a cut of a long tail of microtransactions across thousands of games. Free access with paid virtual currency extras allows Roblox to attract a huge user base, then generate revenue from the subset who buy Robux to unlock content and support creators.

Premium Subscription (Roblox Premium): Roblox offers an optional monthly subscription that gives members a monthly Robux stipend, exclusive items, and other perks. This provides a recurring revenue stream and rewards dedicated users with extra value. Subscribers also enjoy benefits like the ability to trade items or increased earnings if they develop games. By converting a fraction of its users into paying subscribers, Roblox gains predictable income and strengthens retention (players stick around to make use of their monthly Robux and perks).

Advertising & Sponsored Content: While historically Roblox relied mostly on in-game purchases, it is now expanding into advertising as a new revenue stream. The company is integrating immersive ads within its metaverse – for example, virtual billboards or video ads inside games from brand partners like Walmart or Warner Bros. Roblox has begun testing rewarded video ads as well, where players can watch an ad in exchange for an in-game benefit (e.g. an extra spin, a boost in a user-made game). This approach “monetizes attention rather than transactions” and crucially doesn’t require non-paying users to spend money, allowing developers to earn revenue from the majority of players who never purchase Robux. Early examples have been promising – players get something valuable for watching an ad (a win-win), developers get paid, and brands reach engaged users. By 2025, Roblox is building the infrastructure to roll out more advertising and plans to start reporting ad revenue alongside its traditional Robux-based revenue.

Why It’s Successful:

Roblox’s multi-pronged monetization works well due to the scale and engagement of its platform. Key success factors include:

User-Generated Content Ecosystem: By sharing revenue with creators, Roblox incentivized a constant supply of new games and items. This cycle (players buy Robux to spend in games; devs earn Robux and cash out, inspiring more development) keeps the platform content-rich and players spending. The diversity of experiences means there’s always something new to spend on, catering to different tastes and sustaining long-term interest.

Social and Creative Value: Purchases in Roblox often have social currency value – unique avatar outfits, animations, or game perks make players feel special in front of friends. This drives a desire to spend on cosmetics and status items, similar to Fortnite’s appeal, amplified by Roblox’s large social community.

Monetizing Both Payers and Non-Payers: Importantly, Roblox is expanding revenue beyond just the paying minority. The introduction of rewarded ads addresses the huge segment of players who don’t buy Robux (the “vast majority” of Roblox users). Now these players can still generate income by trading a bit of attention for rewards, without feeling forced. This hybrid model (IAP + ads) lets Roblox monetize a wide player base while keeping the game free to play, similar to what top mobile games do. It increases overall ARPU (average revenue per user) in a player-friendly way.

Recurring Revenue & Loyalty: The Premium subscription locks in monthly spend from enthusiasts and gives them extra value (bonus Robux, exclusive content). This boosts loyalty – subscribers are likely to remain active to utilize their perks. It also strengthens the economy (those bonus Robux often get spent on items, funneling back to developers and Roblox).

Roblox’s model has translated into robust financial success. By combining in-game purchases, advertising, and subscriptions, Roblox reported revenue of $801 million in Q1 2024 alone, and annual bookings around ~$4 billion. This diversification helps the business remain resilient and grow (e.g. ads and licensing deals are being rolled out to supplement the core virtual goods income).

Recommendations for Skillz:

Skillz can learn from Roblox by adopting monetisation methods that leverage a platform ecosystem and player engagement:

Cosmetic and UGC Content: While Skillz games are made by third-party developers, Skillz might facilitate cosmetic item systems within its top games or across the platform (e.g. profile customizations, avatars, collectible badges). Developers could be encouraged to offer skins or themes in their Skillz-integrated games (with rev share), similar to Roblox’s catalog of items. This would create new IAP opportunities that don’t compromise fairness (as long as they remain cosmetic or do not affect skill outcomes).

Premium Membership: Taking a page from Roblox (and other services), Skillz could offer a premium subscription tier for players. For a monthly fee, subscribers might get benefits like bonus tournament entries, exclusive competitive events, an ad-free experience, or periodic currency/Token grants. This provides steady recurring revenue and makes dedicated players feel valued. For example, a “Skillz VIP Pass” could grant a few free tournament tickets each day or reduced platform fees, encouraging frequent play and loyalty.

Rewarded Ads: Just as Roblox observed, not all players will pay directly – but many would watch ads for perks. Skillz could integrate rewarded video ads in non-intrusive ways to monetize the non-spending users. For instance, a player who runs out of free tournament entries might watch a 30-second ad to earn another entry ticket or extra Skillz Ticketz (loyalty points). This “win-win” model can increase engagement (players stay longer to earn rewards) and bring in new ad revenue without hurting the competitive integrity (since everyone has the optional opportunity). The key would be to place these opportunities at natural breaks (post-match screens, etc.) and cap the frequency to avoid fatigue.

Candy Crush Saga

Candy Crush Saga is a casual mobile puzzle game (match-3) and one of the most successful mobile games of all time. While not an “esports” title, it represents the freemium monetization model that many mobile games (including competitive ones) use. The game is free to play but generates enormous revenue through in-app purchases and advertising integrations.

Monetization Models Used:

In-App Purchases (Freemium model): Candy Crush pioneered the classic freemium approach. Players can download and play for free, but the game monetizes by selling consumable advantages that ease progression.

Key IAP offerings include extra lives, boosters/power-ups (e.g. Lollipop Hammer, Color Bomb), and extra moves to finish a level. The design intentionally creates moments of frustration or urgency – e.g. running out of lives or being a few moves short of victory – where players are tempted to spend a little to continue. These purchases are positioned as helpful shortcuts and are often bought when a player is deeply engaged and doesn’t want to quit. Over time, this model proved incredibly lucrative: since its 2012 launch, Candy Crush Saga has amassed $7.8 billion in revenue from IAP alone.Rewarded Ads and Ad Placements: In addition to purchases, it integrated advertising in player-friendly ways to monetize those who choose not to pay. Candy Crush lets players watch optional ads in exchange for small rewards – for example, viewing a 30-second ad to get an extra life, a free booster, or to refill the life timer faster. It also occasionally shows interstitial ads between levels (in some versions) or engages in brand collaborations (e.g. themed events) for advertising income. This ad-based model complements the IAP: players who are stuck but don’t want to spend money can still progress by watching an ad, which earns King revenue without feeling overly intrusive. By 2025, advertising accounts for a significant secondary revenue stream for Candy Crush, especially from the large segment of non-paying users. King has effectively monetized a wide player base while keeping the game free, using ads to capture value from players who might otherwise generate none.

Why It’s Successful:

Candy Crush Saga’s monetization success comes from a great execution of the freemium design and continuous engagement,

Mass Appeal and Accessibility: Candy Crush targets a broad audience (casual gamers of all ages) with simple, addictive gameplay. Because it’s free and easy to start, it amassed huge download numbers (over 1.4 billion downloads). This wide funnel of players means even a small conversion rate of payers can yield huge revenue. The game currently still has millions of active users and earns $2–3 million per day in revenue – showing how large its paying audience has become over time.

Psychological Triggers to Drive IAP: King finely tuned the game’s difficulty and reward schedule (using A/B testing and data) to encourage spending without driving players away. The limited lives system creates natural stopping points where impatience can lead to spending. Similarly, offering a booster or extra moves right when a player fails a level by a narrow margin plays on the “just one more try” urge. These tactics convert frustration into purchases, yet because players choose to pay for convenience (and can otherwise wait or retry later), it maintains a sense of fairness and choice.

Retention Through Content & Social Features: A big factor in monetization is how Candy Crush keeps people playing for the long term. King constantly adds new levels (now 17,000+ levels and counting) and regular events or challenges. This endless stream of content gives players always something new to come back for. Social features (leaderboards, friend progress, contests) provide friendly competition and motivation to advance. High engagement and retention translate to more opportunities for players to eventually hit a paywall and spend. Notably, Candy Crush’s yearly revenue has grown each year even a decade after launch, hitting a record $1 billion in 2024 – a sign that their monetization design is sustaining player LTV effectively over time.

Hybrid Monetization Capturing All Users: Candy Crush exemplifies the “hybrid strategy” now common in mobile games: combining IAP + ads for maximum yield. IAPs drive the bulk of revenue (especially from the minority of “whale” spenders who make frequent purchases), while ads provide incremental income from the majority who won’t pay. According to recent data, “the bulk of Candy Crush’s revenue comes from in-app purchases... however, advertising also plays a role, especially from non-paying users”. By offering multiple monetization pathways, King ensures the game makes money from virtually everyone, one way or another, without forcing any single method on the player. This strategy has made Candy Crush one of the most profitable mobile titles ever while maintaining a large, happy player base.

Recommendations for Skillz:

For a competitive platform like Skillz, Candy Crush’s strategies highlight ways to monetize casual players and retain users, which could be adapted in a skill-gaming context:

Freemium Entry with In-App Purchases: Skillz could explore offering certain games or modes for free to attract a larger audience, then use in-app purchases for enhancements that do not tilt competition. For example, selling extra tournament entries or retries could mirror Candy Crush’s extra lives model. A player who loses a match or runs out of entry tokens might pay a small fee to immediately join another match, rather than waiting. As long as matchmaking remains fair (e.g. rematches don’t disadvantage others) and any purchasable power-ups don’t create pay-to-win scenarios, this could add revenue. In fact, entry tickets for tournaments are already a known model in skill-based games – selling them as IAP (or as bundles with discounts) could boost ARPU from engaged players who want more chances to compete.

Rewarded Ads for Second Chances or Bonuses: Skillz can integrate ads that reward players in ways that enhance the experience without breaking fairness. For instance, a player who just lost a close match might be offered: “Watch an ad to get a free retry against a new opponent” or “Watch an ad to earn some bonus Skillz Ticketz (loyalty points)”. This echoes Candy Crush’s approach of giving extra lives or moves for watching ads. It creates a positive loop: the player gets a helpful perk for free, and Skillz earns ad revenue – “a win-win situation: the player gains something useful, and the developer earns ad revenue”. Such voluntary ads feel more acceptable to players than forced pop-ups, especially if framed as helpful boosts. By carefully managing frequency and placement (e.g. only after matches, not mid-game), Skillz can ensure this monetization doesn’t frustrate users. Instead, it can increase engagement (players stick around to use their “rewarded” second chance or bonus) and monetize users who might never spend real money.

Ongoing Content & Challenges: While Skillz doesn’t create the games, it can introduce platform-level events or challenges to drive retention. Candy Crush’s constant updates show the value of new content. Skillz could host seasonal tournaments, leaderboards, or skill challenges with small entry fees or sponsored prizes. This keeps the experience fresh and gives players more reasons to return regularly – thereby increasing opportunities for monetization (whether through fees, IAP, or ads). A “battle pass” style challenge system (as discussed for Fortnite) could also be combined here: e.g. a monthly challenge card where completing certain competitive tasks grants rewards, encouraging players to keep playing daily or try different games on the platform.

Part 2: Player-Centric Opportunity Sizing

Using Quarterly Earnings Report Skillz data, estimate: (Link to Q2 Earnings Data)

% of players likely to adopt cosmetic items, subscriptions, or ad-based models.

Potential incremental revenue each model could bring in 12 months.