Should Google get into the Ticketing Market?

Part 1 - Product Strategy Interview Question : Should Google get into the ticketing market? Part 2 - If so, then what would you build.

This is a two-part problem, so I’ll structure my response accordingly:

First, I’ll evaluate whether Google should enter the ticketing market based on strategic alignment, market opportunity, user needs, and competitive dynamics. (Part 1)

Then, assuming a "yes," I’ll outline what product Google should build, including the target users, value proposition, MVP features, monetization strategy, success metrics, and potential risks. (Part 2)

To guide this, I’ll use a structured product strategy framework covering:

Clarifying Questions

Current State: What Google Already Does

Market Analysis

Market Size (TAM, SAM, SOM)

Key Segments & Trends

User Behavior Insights

Competitor Landscape

India – Domestic Competitors

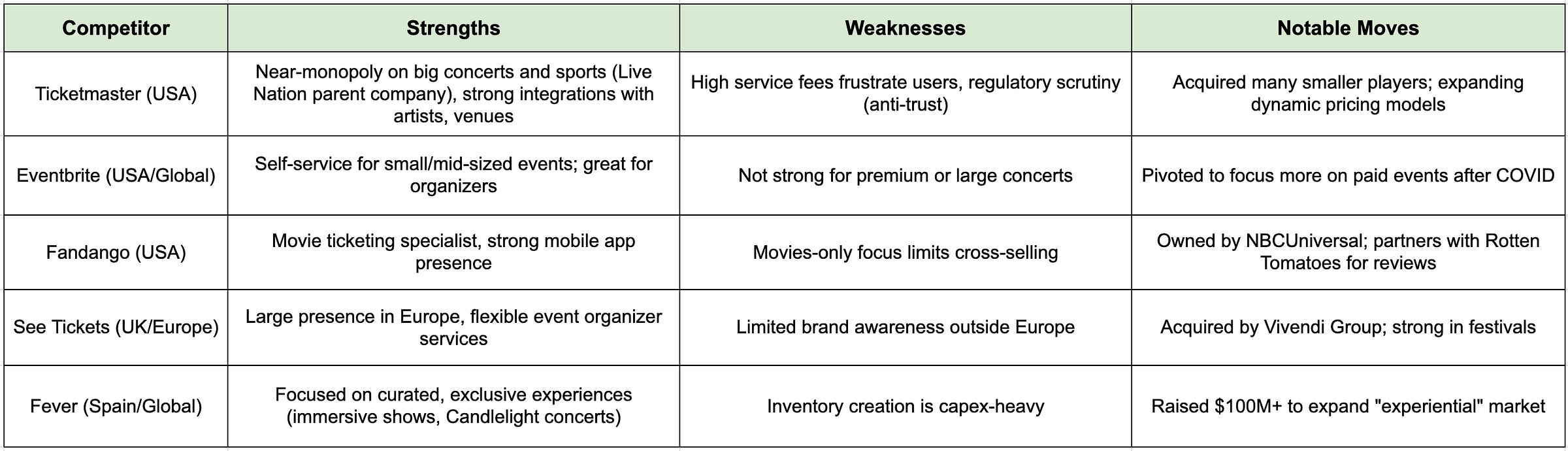

Global – International Competitors

Emerging Trends Among Competitors

Strengths vs Weaknesses Comparison

Google’s Position

Barriers to Entry for Google

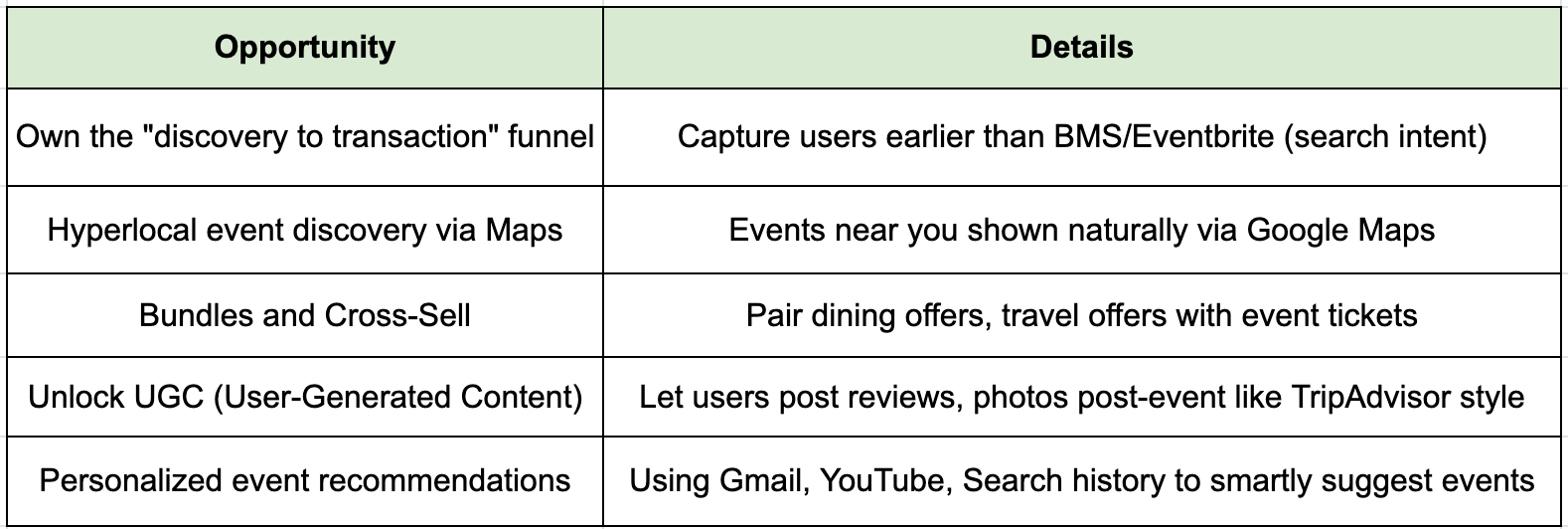

Key Opportunities for Google

Google’s Unique Advantages

Effort and Risks:

Effort Required to Enter

Cost of NOT Entering

Risks / Downsides of Entering

Strategic Fit

Recommendation

Risks Mitigation Plan

Summary

1. Clarifying Questions

Before diving into the analysis, I’d like to ask few clarifying questions to better frame the problem:

Q1) Are we focusing on ticketing for live events (concerts, plays, sports), movies, tourist attractions (museums, exhibits), or also including travel ticketing (airlines, buses, public transport)?

Interviewer: For the scope of this question, focus only on live events, movies, and tourist attractions. Exclude travel ticketing like airlines or public transport.

Q2) Geographic Focus: Should I think about launching this globally, prioritize certain markets (like US, Europe, India), or focus only on North America?

Interviewer: Think globally, but tailor the strategy to local nuances where needed.

Q3) Are we expected to build a full end-to-end transactional system (discovery → booking → payment) or just improve the discovery layer (information aggregation)?

Interviewer: Prioritize end-to-end experience—discovery, availability, booking, and payment should all happen within Google's ecosystem.

Q4) Should I assume we will build direct partnerships with event organizers/venues, or primarily aggregate through third-party ticketing platforms?

Interviewer: Assume a mix—Google will build direct partnerships with major venues and self-serve onboarding for smaller organizers.

Q5) Is the goal to charge a booking fee, take a revenue share from event organizers, or purely drive ad revenue growth through better search engagement?

Interviewer: Assume a transaction-based revenue model (booking fees, revenue share), but design it to complement Google's existing ad-driven ecosystem.

Q6) Should I prioritize the experience on Search, Maps, or YouTube—or design a unified flow across all touchpoints?

Interviewer: Its upto you to decide.

Q7) Should the initial rollout target specific user demographics, like urban, younger, smartphone-savvy users, or design for general public usage?

Interviewer: Its upto you to decide.

Q8) Should I assume that existing ticketing aggregators (Bookmyshow, Ticketmaster, Stubhub, Fandango) will react aggressively, possibly pulling back ad spend or suing over anti-competitive behavior?

Interviewer: Be aware of competitive backlash, but assume Google is willing to manage short-term friction for long-term strategic gains.

Q9) Are there additional privacy, regulatory, or anti-trust considerations beyond Google's standard best practices (GDPR, CCPA)?

Interviewer: Follow standard privacy best practices. Be especially mindful of anti-trust optics when vertically integrating into the ticketing market.

Q10) Should we optimize primarily for ticket revenue, user engagement, increase in Search/Maps/YouTube usage, or a combination?

Interviewer: Aim for a combination of sustainable revenue growth and improved user engagement across Google services.

Q11) What is Google’s entry strategy — build, partner, or acquire?

Interviewer: It upto you to decide.

2. Current State: What Does Google Already Do?

When users search for movies, events, or attractions ("movies near me," "concerts in Mumbai," "Broadway shows NYC"), Google Search shows:

Basic event metadata / movie details (timing, venue, address)

Reviews, snippets of price ranges

Navigation through Google Maps

However, for actual booking, users are redirected to third-party platforms globally. Competitors,

India: BookMyShow (movies, live shows), Paytm Insider (live events, sports, experiences), PVR Cinemas

USA: Fandango (movies, cinema chains), Ticketmaster (concerts, sports), Eventbrite (community events, conferences)

There is no native flow where a user checks real-time seat availability, selects seats, buys the tickets, and stores a ticket without leaving Google.

Even for promotions, thrid party platforms heavily rely on Google/Youtube and Google is dependent on third party platform for listing and inventory.

However, there is no direct "buy ticket" inside Google yet.

Example:

Searching "Shah Rukh Khan movie tickets Mumbai" → Google shows theaters and showtimes → redirects to BookMyShow.

Searching "Taylor Swift concert tickets Los Angeles" → redirects to Ticketmaster.

3. Market Analysis: Ticket Booking & Event Discovery

Market Size (TAM, SAM, SOM):

India Market Breakdown:

🎯 Total Addressable Market (TAM)

Definition: The complete revenue potential from all ticketed live events, movies, and tourist attractions in India.

Estimate: Approximately $1.7 billion by 2026.

🎯 Serviceable Available Market (SAM)

Definition: The segment of the TAM that is accessible through online platforms, focusing on urban and semi-urban consumers.

Estimate: Around $1.2 billion.

Rationale: Onmanorama: Kerala News & Videos, Business Standard

🎯 Serviceable Obtainable Market (SOM)

Definition: The portion of the SAM that a new entrant, such as Google, could realistically capture in the short to medium term.

Estimate: Approximately $120–180 million (10–15% of SAM).

Rationale: Reanin, Fundamental Insights Consulting, Verified Market Research

Global Market Snapshot

🎯 Total Addressable Market (TAM)

Estimate: The global ticketing market was valued at $419.7 billion in 2024, projected to reach $1.4 trillion by 2031, growing at a CAGR of 19.2%. Reanin

🎯 Online Event Ticketing Market

Estimate: Valued at $60.1 billion in 2024, expected to grow to $111.4 billion by 2033, with a CAGR of 7.1%. Custom Market Insight

Key Segments & Trends:

User Behavior Insights

Users often search broadly first ("things to do this weekend") instead of searching specific events → Google is strong here.

In India, ~90% ticket bookings happen via mobile. Globally mobile bookings are 70%+ now.

India: Very price-sensitive; discounts, wallet offers matter a lot.

USA/Europe: More willing to pay premium for premium seats, VIP experiences.Reviews, ratings, "trending now" influence event choice heavily.

BookMyShow in India shows "how many people booked" — similar nudges could help Google.